.jpg)

Investors

Empowering investors with greater visibility into daily risks, liquidity, and market values of private shares.

.webp)

Investors have come to expect timely, reliable, and precise data for liquid public asset classes, however such transparency is not yet readily available in the private markets.

ApeVue’s independent data services provide the objective market insights investors need to enhance their decision making with regular updates on private security pricing, valuations and liquidity activity data.

By offering daily pricing of private company shares and reliable assessments of share class structure, ApeVue’s ability to quickly access and provide data from both primary and secondary sources has significantly improved service delivery.

ApeVue provides investors with a much greater number and quality of data points, helping them make better informed decisions to generate alpha.

Deal Sourcing and Price Discovery

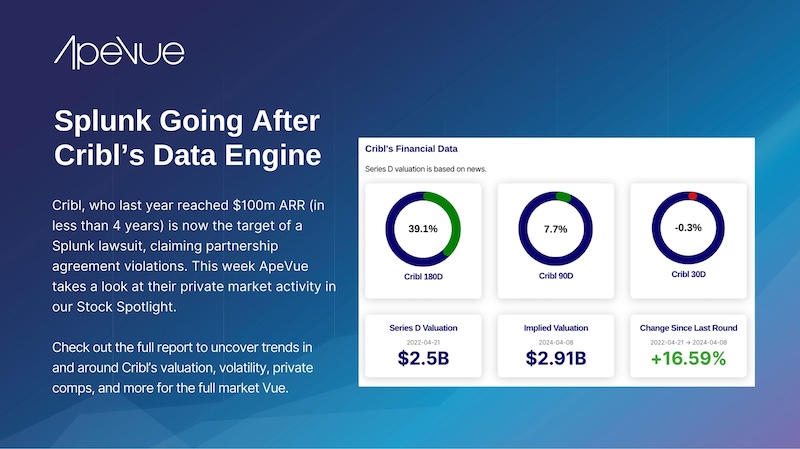

Rely on our deep history of time series information coupled with daily pricing updates extending well beyond prior funding rounds.

Portfolio Market NAV

Track company stock values using a cost-effective independent party for private investments.

Industry Performance

Stay on top of market movements with proprietary performance benchmarks including the ApeVue50 and various industry sector benchmarks.

Compliance & Audit

Maintain objectivity in your evaluations, benefiting from strong market context and fair value accounting best practices.

Schedule a demo with one of our experts

Multi-Asset Fund Managers

Tracking pre & post-trade private exposure for Pensions, Endowments, 1940 Act Mutual Funds, and Hedge Funds.

- Write up/down valuations less aggressively

- Accommodate market and liquidity adjustments on pricing

- Additional context to defend valuations with pricing committees and auditors

Venture Capital Funds

Source investment opportunities with more granular and timely company details for top-tier growth stage and beyond.

- Gain new perspectives and insights around investable names

- Increase the independence and reliability of valuations supplied to LPs served

- Increase context for LP stake transfers and remain aligned to the SEC Private Fund advisers Rules

Secondary Market Participants

Confidently trade and value private companies with daily, granular secondary market data designed specifically for institutional private investors.

- Gauge equity tranche volatility and liquidity over time to identify opportunities

- Stay ahead of private market activity and fluctuations via the AV50 and industry sector benchmarks

- Maintain independent visibility for LP needs such as transfers and data validation

Ready to see it in action?

Schedule a demo with one of our experts

.jpg)

.png)

.png)

.png)

.png)

.png)